Learn more about Auditors

by Margo

Posted on 23-10-2020 05:33 AM

In addition to meetings with financial executives, auditors spend a significant amount of time researching companies’ industries and learning about their prior audit history.

Related to Auditors Job Description

Most accountants and auditors need at least a bachelor’s degree in accounting or a related field.

If you are looking to hire a similar role, then you might find one of these related job description samples to be useful: night auditor.

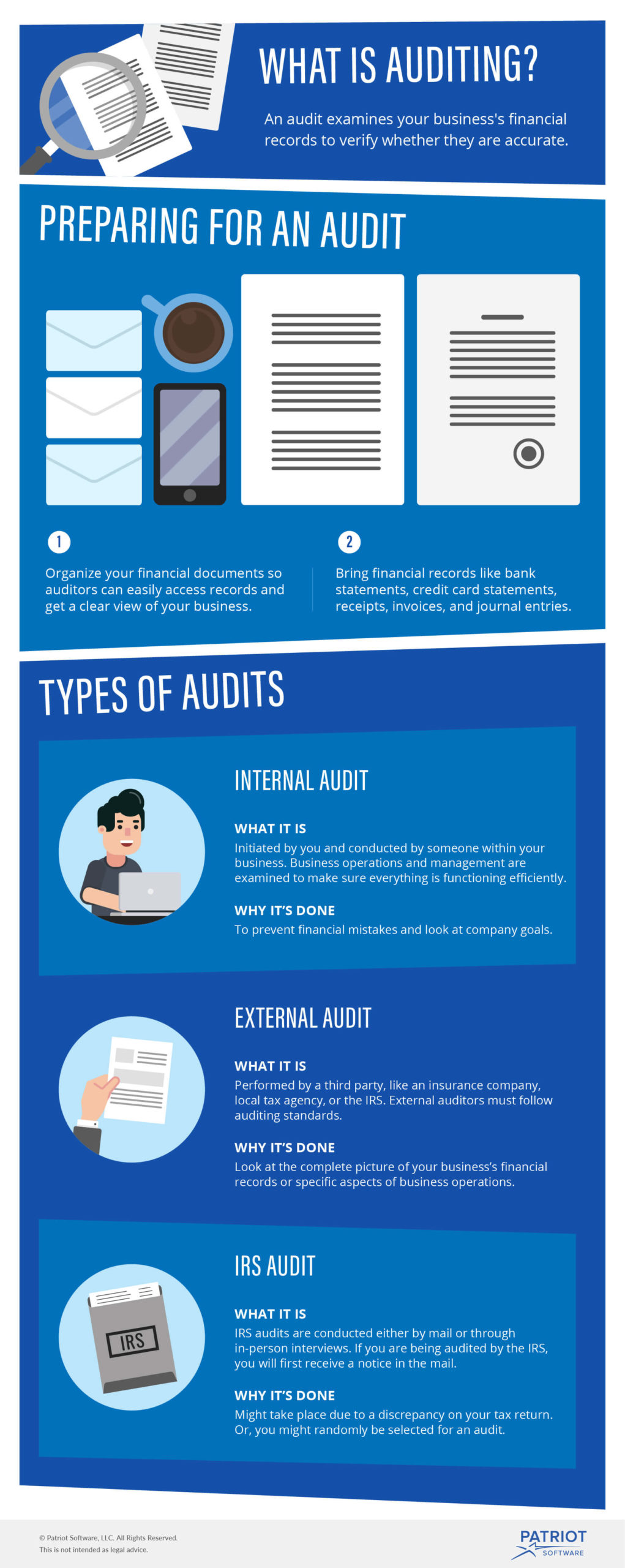

What is an audit?

In the past, companies often relied on accountants from their audit firms to assist in reconciling accounts, preparing the adjusting journal entries and writing financial statements. Small companies, in particular, often lacked the level of accounting sophistication necessary to carry out these tasks. Relying on the audit firm often made sense from the perspective of efficiency and cost containment.

All campus-related arts and cultural centers all other campus-related organizations selected programmatic and control concerns at community colleges when directed by the vice chancellor the oua, in the performance of audits, is granted full and complete access to all suny sites, employees, functions, and records, including electronic media, in order to adequately carry out assigned responsibilities.

Auditing is a process where a financial specialist, typically trained in accounting methods, reviews and assesses an entity's financial records, uses of funds and compliance with financial controls. In the private sector, auditing is a mechanism that is used to ensure that companies operate in the best interests of their investors, and not for the financial gain of insiders. Likewise, auditing performs a similar function in the public sector , with the caveat that any discrepancies revealed by an audit can result in criminal and civil consequences.

Remove auditing limitations and capture change information without the need for native audit logs, resulting in faster results and significant savings of storage resources.

Greeting and checking in guests upon arrival and providing them with relevant hotel information auditing and balancing reports from the day shifts answering phones, scheduling wake-up calls and taking reservations verifying that all end-of-day tasks have been completed by other departments responding to guest inquiries, concerns and complaints as needed running end-of-day reports before the close of the shift.

Background during the clarity redrafting of isa 720 other information in documents containing audited financial statements, and the consultations on the iaasb's strategy and work program, 2009-2011, several stakeholders drew the iaasb's attention to the need to update and revise the isa to ensure that it is sufficient and fit-for-purpose in the context of today's financial reporting environment. This view was shared by members of the iaasb consultative advisory group (cag). The iaasb considered the input received and agreed to include consideration of a proposal to revise isa 720 in its 2009-2011 work program.

Develop an annual audit plan using an appropriate risk-based methodology and submit the plan to the board of regents through the committee on audit for review and approval. Implement the annual audit plan and report results to the board of regents, chancellor and the university presidents and agency directors. Provide reports to the committee on audit and chancellor on the implementation status of prior audit recommendations.

What don't auditors do?

The u. S. Bureau of labor statistics (bls) predicts faster than average job growth for accountants and auditors between 2016 and 2026.

It is important to remember that auditors are trying to verify compliance, not to find something wrong. In general, the auditor just wants people during the audit to give the information they know without making something up, and if they need to look up a particular piece of information, that is acceptable. In the end, the auditor just wants to be able to demonstrate that what was planned to be done was done.

We are looking to hire an it auditor with an analytical mind and expertise in it systems, applications and infrastructure. It auditors are expected to have outstanding problem-solving skills, a meticulous attention to detail and a great understanding of cyber security trends. To ensure success, an it auditor must be capable of maintaining the confidentiality of sensitive information while working with a variety of technologies, security problems and troubleshooting of the network. Top candidates will display an excellent understanding of firewalls, vpn, data loss prevention, ids/ips, web-proxy and security audits.

In the auditor’s evaluation of whether the financial statements are presented in conformity with us gaap, they consider whether the financial statements contain all required disclosures, including those related to going concern, if applicable. As part of this evaluation, auditors assess management’s going concern evaluation. Pcaob auditing standard 2415, consideration of an entity’s ability to continue as a going concern (as 2415) requires the auditor to, among other things, evaluate whether there is substantial doubt about the company’s ability to continue as a going concern for a reasonable period of time, not to exceed one year beyond the date of the annual financial statements being audited. The auditor’s evaluation is based on his or her knowledge of conditions and events that exist or have occurred prior to the date of the auditor’s report. As 2415 does not require auditors to design audit procedures solely to identify conditions and events that, when considered in the aggregate, indicate there could be substantial doubt about the entity’s ability to continue as a going concern. Rather, the auditing standard suggests that the results of auditing procedures performed to achieve other audit objectives be leveraged to identify such conditions and events. As 2415 provides the following examples of the types of audit procedures that could be used:.

Audit , fraud over the past few years, it can be seen that auditors’ responsibilities towards reporting any possible gaps in the financial statements have increased exponentially. This is primarily because of the major scandals that have greatly impacted the accounting profession as a result of the fraud. Therefore, in order to maintain integrity and confidence in the profession of accounting, it becomes rudimentary for auditors and directors to understand their role in the prevention and detection of fraud.

As defined by institute of internal auditors, internal audit an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. The internal audit activity helps an organization achieve its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

What can't auditors do?

Four statements in the survey assessed lenders’ perceptions in terms of responsibility. Eighty percent of respondents agreed with statement 9, “the clarification of the auditor’s responsibility for fraud implies that auditors have a greater responsibility to detect financial statement fraud. †approximately 6% disagreed with the statement, and 14% neither agreed nor disagreed. For statement 10, “the clarification of the auditor’s responsibility for fraud indicates that auditors devote more effort and time in performing the audit to assess the risks of material mis-statement of the financial statements,†approximately 76% of respondents agreed, while only 9% disagreed and 15% neither agreed nor disagreed.

Benefits of the cfe credential according to generally accepted auditing standards (gaas), the external auditor must brainstorm potential fraud risks during the planning process and then gather information necessary to identify the risk of material misstatement due to fraud. The cfe credential provides external auditors with the knowledge and skills needed to effectively identify these fraud risks and detect fraud when conducting an audit. Additionally, cfes are well-equipped to perform data analysis techniques to detect fraud, evaluate accounting systems, determine the degree of organizational fraud risk and follow up on fraud indicators. The cfe credential is preferred by many employers, and external auditors who have earned it are looked to as leading experts in the field.

Auditors are trained on their audit responsibilities, but do the managers of the areas to be audited understand their audit responsibilities? the objectives of an audit are to determine conformity to the audit criteria, evaluate the capability to meet customer needs, ensure compliance with legal requirements, and determine the effectiveness of the management system.

External auditors are responsible for auditing the company's financial statements and providing reasonable assurance that they are presented fairly and in conformity with gaap and that they reflect true representation of the company's financial position and results of operations. Auditors are also required to express an opinion on the effectiveness of the design and operation of icfr. The external audit function is intended to lend credibility to financial reports and reduce information risk that financial reports are biased, misleading, inaccurate, incomplete, and contain material misstatements that were not prevented or detected by the icfr system.

The month of may is designated international internal audit awareness month by the institute of internal auditors, global (iiag). The guyana chapter is affiliated to the iiag, hence it has planned a month of activities to recognise this noble profession. One of its activities is to publish articles on the internal audit profession in order for practitioners to develop, among others, their skills and knowledge.

How is the audit conducted?

1. An examination and verification of a company's financial and accounting records and supporting documents by a professional, such as a certified public accountant. 2. An audit is an irs examination of an individual or corporation's tax return , to verify its accuracy. There are three types of audits: correspondence audits (the irs mails a request for additional information), office audits (an interview is conducted at a local irs office), and field audits (an interview is conducted at a taxpayer's place of business , for a corporate tax return ). Since there is always the chance of an audit, experts recommend keeping good records to support all the information in a return. The reason detailed and accurate bookkeeping is so important is that the burden of proof is on the filer, not the irs.

Internal Auditor vs. External Auditor

An external audit goes way beyond sitting down and adding up a column of numbers. First, the auditor learns about the business and the financial environment in which it operates. Then, she reviews the company's internal controls, such as who authorizes spending and purchasing, how assets are secured and whether the company has sufficient internal oversight in money management. If it looks like there's a substantial possibility of fraud, the auditor will be much more cautious and suspicious when reviewing the financial statements.

How Can an Internal Auditor be Impartial and Objective?

We are looking for an objective internal auditor to add value and improve our operations by bringing a systematic and disciplined approach to the effectiveness of risk management, control, and governance processes. The successful candidate will possess a thorough knowledge of accounting procedures and a sound judgement.

How to Become an Internal Auditor

If you are an internal auditor, you can picture this scene because it has probably happened to you. You are at a party or some other social event and the conversation turns to work. Someone asks what you do for a living. “i work in internal audit,†you explain. What is that? you explain as best you can, but not everyone gets it. So you try and make your explanation easier to understand—probably too easy. And then someone says it: “ah, so it’s like internal affairsâ€.

Based on the conflict in roles as statutory and internal auditor simultaneously, the bar on internal auditor of an entity to accept tax audit under income tax act, 1961 will also be applicable to gst audit, the icai said. Etcfo september 29, 2018, 09:17 ist the institute of chartered accountants of india ( icai ) has clarified that an internal auditor in a company cannot undertake gst audit of the same entity, citing the issue of conflict of interest.

An entry-level internal auditor with less than 1 year experience can expect to earn an average total compensation (includes tips, bonus, and overtime pay) of r157,289 based on 54 salaries. An early career internal auditor with 1-4 years of experience earns an average total compensation of r225,251 based on 399 salaries. A mid-career internal auditor with 5-9 years of experience earns an average total compensation of r371,974 based on 189 salaries. An experienced internal auditor with 10-19 years of experience earns an average total compensation of r397,873 based on 70 salaries. In their late career (20 years and higher), employees earn an average total compensation of r418,959.

How to become an auditor

In your first year as an auditor your time will be split between working and studying. You may also travel frequently and may decide to become involved in extracurricular activities organised by your employer, such as sports teams and csr operations.

Job duties and tasks for: "auditor" 1) collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies. 2) report to management about asset utilization and audit results, and recommend changes in operations and financial activities. 3) prepare detailed reports on audit findings. 4) review data about material assets, net worth, liabilities, capital stock, surplus, income, and expenditures.

We are looking for an external auditor to scrutinize the financial statements of organizations and report on their financial positions. Shareholders will depend on your evaluations to make informed decisions. To succeed in this role, you should be an exceptional communicator with an analytical mind, attention to detail and sound judgement. We want someone who’s objective and speaks their mind boldly.

01        the objective of the ordinary audit of financial statements by the independent auditor is the expression of an opinion on the fairness with which they present, in all material respects, financial position, results of operations, and its cash flows in conformity with generally accepted accounting principles. The auditor's report is the medium through which he expresses his opinion or, if circumstances require, disclaims an opinion. In either case, he states whether his audit has been made in accordance with the standards of the pcaob. These standards require him to state whether, in his opinion, the financial statements are presented in conformity with generally accepted accounting principles and to identify those circumstances in which such principles have not been consistently observed in the preparation of the financial statements of the current period in relation to those of the preceding period.

On of the key responsibilities of an auditor with regards to making due diligence on a prospectus is to verify all financial statements, including balance sheet, profit and loss statements, and cash flow statement. All accounts need to be checked and verified. If the firm presents consolidated statements of all its affiliates the individual statements comprising the consolidated statements need to be diligently verified as well.

This free auditor job description sample template can help you attract an innovative and experienced auditor to your company. We make the hiring process one step easier by giving you a template to simply post to our site. Make sure to add requirements, benefits, and perks specific to the role and your company.

Why audits are necessary

Financial audits are expensive. There’s no way to beat around the bush, when we talk about costs and “audits. †they’re never cheap, if done properly by a reputable certified public accountant (“cpaâ€). Rarely, if ever will you be able to call a random cpa and obtain a quote for an audit. I’ve yet to find a client that was able to get a quote without turning over a great deal of information. But, i promise that an audit will never be less than $10,000 dollars.

A social media audit is the process of reviewing your business’ metrics to assess growth, opportunities and what can be done to improve your social presence. Don’t let the word “audit†freak you out, by the way. Social media audits aren’t painstaking or tedious (or at least they don’t have to be).

The following is an excerpt from the complete guide to the cqa (qa publishing, llc) by steve baysinger, which is out of print. Complete coverage of quality audit techniques may be found in the handbook for quality management (2013, mcgraw-hill) by paul keller and thomas pyzdek

financial statements are used for a variety of purposes and decisions. For example, financial statements are used by owners to evaluate management's stewardship, by investors for making decisions about whether to buy or sell securities, by credit rating services for making decisions about credit worthiness of entities, and by bankers for making decisions about whether to lend money. Effective use of financial statements requires that the reader understand the roles of those responsible for preparing and auditing financial statements.

Search

Categories

- Stock Trader

- Criminologist

- Coworker Leaving

- Mortician

- Virologist

- Veterinary Technician

- Title Examiner

- Team Leader

- Technical Recruiter

- Senator

- Scribe

- Perioperative Nurse

- pediatrician

- Modeller

- Military

- Economist

- Coworker

- Captain

- Arborist

- Voter

- 14

- 12

- Worker

- Chemistry

- Actuary

- Actor

- Announcer

- Wellness Nurse

- Judge

- Academic Dean

- Administrator

- Agricultural

- Administrative Assistant

- Agronomist

- Barber

- Analyst

- Pharmacist

- Call Center Support

- Cameraman

- Interventional Radiologist

- Wedding Officiant

- Politics

- Public Health

- Respiratory Therapist

- Singer

- Sniper

- Teacher

- Manatee

- Hacker

- Gambling

- Flight Attendant

- Entertainer

- Employee

- Daily Nutritionist

- Kitchen Manager

- Astronomer

- American Upholsterer

- Activist

- Accountant

- Writer

- Vice President

- Inventor

- Drafter

- Debater

- Carpenter

- Baker

- Attorney

- Astronaut

- Advisor

- Occupational Therapist

- Nutritionist Fact

- Municipal Arborist

- Management

- Mail Carrier

- Livestock Farmer

- Landscape Contractor

- Land Surveyor

- Insurance Investigator

- Insurance Broker

- Inspector

- Hunter

- Historian

- Hiker

- Hairstylist Black

- Hairstylist

- Gunsmith

- Gun Shooter

- Grant Writer

- Government Auditor

- Gold Panning

- Gardener

- Forensic

- Fisherman

- Fireman

- Firefighter

- Esthetician

- Entrepreneur

- Engineer

- EMT

- Electrician

- Driller

- Doctor

- Diver

- Dispatcher

- Dishwasher

- Director

- Dietitian

- Detective

- Dancer

- Creative Writing

- Counselor

- Cloud Architect

- Climber

- Chef

- Chairman

- Cardiac Sonographer

- Boss

- Bookkeeper

- Bee Keeper

- Bartender

- Auctioneer

- Architect

- Appraiser

- Watchmaker

- Wanker

- Typist

- Trooper

- Train Controller

- Tool and Die Maker

- Therapist

- Technician

- Surgeon

- Supervisor

- Stripper

- Soldier

- Sociologist

- Social Worker

- Sheriff

- Sexy Pick Up Lines

- Self Reminder

- Secretary

- Scientist

- Scheduler

- Sailor

- Roofer

- Marshal

- Manager

- Librarian

- Lawyer

- Landscaper

- Investigator

- Retirement

- Registered Nurse

- Recruiter

- Records Clerk

- Realtor

- Rancher

- Quilter

- Psychology

- Psychologist

- Principal

- Priest

- Postmaster

- Office Assistant

- Nutritionist

- Nurse

- Network Administrator

- Mechanic

- Mayor

- Podiatrist

- Plumber

- Planner

- Pipe Fitter

- Pilot

- Photographer

- Phlebotomy Technician

- Painter

- Nurse Practitioner

- Identifier

- Lacemaker

- HRD

- Hatter

- Host

- Herdsman

- Bouldering

- Assassin

- Bomberman

- Army

- Attendant

- Blogger

- Clergyman

- Cashier

- Botanist

- Bodyguard

- Aquascaping

- Assistant

- Electorate

- Physician

- Arbitrator

- Administrative