Bookkeeper Job Description: 9 Skills Needed to Bookkeep

by Emma

Posted on 15-10-2020 10:30 PM

Bookkeepers keep the accounting filing system in order and organize the business’ financial records. It’s no wonder that organizational skills go hand in hand with the previous bookkeeper job description we discussed. With all the transactions and documents you need to keep track of, working in an organized manner is a must.

The bookkeeper job description clearly outlines the primary responsibilities, duties and skills of the bookkeeper job. Certain bonus gift to bookkeeper coffee mug for bookkeeper bookkeeper mug duties will vary according to the individual needs of the company but the core functions of the bookkeeper job remain unchanged. There is a high demand for good, accurate bookkeepers, they are key to.

Ultimately, launching a bookkeeping career can be a great move. It’ll let you work your way into the world of accounting and finance, something that will remain relevant until essentially the end of time. Just make sure to use the information above to your advantage. By reviewing the bookkeeper job description, knowing what skills you need to showcase, and being ready for your interview, you increase your odds of standing out for all of the right reasons. And, when it comes time for the hiring manager to make a decision, each and every one of those things can matter.

Posted: (20 days ago) the bookkeeper job description clearly outlines the primary responsibilities, duties and skills of the bookkeeper job. Certain bookkeeper duties will vary according to the individual needs of the company but the core functions of the bookkeeper job remain unchanged. Https://carehealthjobs. Com/secretary-bookkeeper-job-description apply now view all jobs.

Bookkeepers don’t need a degree to get started, and some start working with zero experience and gain on-the-job training (more on this a little further down). But training and experience aside, there are a few things every bookkeeper should be good at: math: your job is working with numbers, so having solid math skills is important. This job doesn’t require high-level math, but you should be able to track credits and debits without financial software if needed.

As i said before, you don’t need any special qualifications to start working as a bookkeeper. But you still need to learn the basic skills needed for the job. Any new career will require an amount of training, and bookkeeping is no different. There are 3 ways to learn the necessary skills:.

Bookkeeper Job Description: Bookkeeping Skills You Need to Have

Bookkeeping is a process of recording, storing, analyzing, and interpreting the financial transactions of a company. The primary function of a bookkeeper is to create financial statements to enable the accountant to easily and timely carry out tax management and legal processes.

A bookkeeper's job description may vary depending on people's different perspectives. It, however, outlines and explains the primary roles of a bookkeeper. The duties may vary depending on a company's needs, but the primary functions of bookkeeping remain unchanged. Nowadays, there has been a high demand for good and accurate bookkeepers. This is because they are the primary key to running the critical operations.

6 Tips To Finance A Small Business

Yes, you need to make quarterly sales tax payments as well. Taxes aren't just an annual occurrence for small businesses. Stay up to date and informed. Here's some great tax tips to answer any questions you might have when it comes to small business tax preparation.

Bookkeeping services for small business near me small business tax help how to organize business expenses tips on how to run a small business successfully how to make a budget for a small business what is an equity account how to write off bad debt fixed assets examples how to calculate unemployment tax bookkeeping and accounting services near me.

A bookkeeping class will give you a great overview of the primary functions and concepts of bookkeeping, such as financial statements and journal entries, as well as how to record expenses, profits, revenues, losses, and much more. Some will also cover how to use popular bookkeeping software and may even offer bookkeeping certifications upon course completion. The level of detail and length of the course will depend on whether the classes are designed for someone looking to launch a career or simply help keep track of their small business finances.

Unless you are an accountant or a fan of working with numbers, bookkeeping is probably not your favourite task. But adopting some good habits early can help you avoid costly errors when it comes to record keeping. That’s why we’ve put together these five bookkeeping tips for small business. You probably keep a lot of the financial details of your business in your head: which supplier you need to pay, which customers are outstanding, etc. It’s understandable to do it this way, you won’t need to learn a new software, there is no danger of a system crash that loses all your data, and you can tweak your budget as often as you need without sitting down at a desk.

July 7, 2016 pchrisnow accounting , bookkeeping , business no comments jared hecht ceo and co-founder of fundera, the most trusted marketplace for connecting small business owners with the best funding provider. Ever caught a mistake while balancing your checkbook or reconciling your bank account statements? if so, you know how easy it is to make an error. “is that a 1 or a 7? is that decimal point in the right place?†you also know what a mess they can make of your finances.

Even though you are outsourcing the actual day-to-day bookkeeping duties, it’s still a very good idea for a small business owner to have at least a basic understanding of a bookkeeper’s duties. That will prevent someone from taking advantage of you. Knowing the basics of their duties and of your business financials will go a long way towards preventing any fraud and every business owner should have a good handle on his or her company’s finances.

Tips from startups on how to pick the number cruncher that's right for your small business….

Bookkeeper Job Description: What Does a Bookkeeper Do?

Asked and answered

by john w.

Olmstead, mba, ph. D, cmc

q. I am the owner of a five attorney firm in chicago. Including staff we have a total of 13 people working at the firm. As we have grown our approach to handling billing and accounting has been piecemeal. We have a combination of several people handling various tasks including a couple of outsourced vendors as well. Frankly it is a mess. I want to restructure and consolidate all the tasks and responsibilities into one bookkeeper position. Do you have a job description that would help guide me in my search?.

Olmstead, mba, ph. D, cmc

q. I am the owner of a five attorney firm in chicago. Including staff we have a total of 13 people working at the firm. As we have grown our approach to handling billing and accounting has been piecemeal. We have a combination of several people handling various tasks including a couple of outsourced vendors as well. Frankly it is a mess. I want to restructure and consolidate all the tasks and responsibilities into one bookkeeper position. Do you have a job description that would help guide me in my search?.

This bookkeeper job description template includes key bookkeeper duties and responsibilities. You can post this template on job boards to attract prospect applicants.

Below is our bookkeeper job description. You can post it as-is to an online job board like ziprecruiter, or download and customize it to match the unique aspects of your business. Keep in mind that adding a custom company overview and description of the work environment (outlined above) will help you draw in the right applicants.

Jan haugo business is changing, but you know that because we are reminded every day via email, twitter, facebook and the news. Typically, the role or job that is in a company has a definite job description. The independent bookkeeper does not have a defined role. Oh, i know what you are saying … i have an engagement letter. The typical bookkeeper knows what services they provide to the client and the expectations. However, the changing pace and environment of industry and business technology make our roles vary every day.

Bookkeeper plays a very important role is running an organization and is of key help to business owner or manager. The bookkeeper job description should clearly outline the primary responsibilities and tasks of the bookkeeper for any organization. Though core education for a bookkeeper may be high school but an associate degree with accounting knowledge will be an added advantage to business.

Question: i am the owner of a five attorney firm in chicago. Including staff we have a total of 13 people working at the firm. As we have grown our approach to handling billing and accounting has been piecemeal. We have a combination of several people handling various tasks including a couple of outsourced vendors as well. Frankly it is a mess. I want to restructure and consolidate all the tasks and responsibilities into one bookkeeper position. Do you have a job description that would help guide me in my search?.

Useful bookkeeper job description pages

139+ free job description templates - download now adobe pdf, microsoft word (doc), google docs, apple (mac) pages.

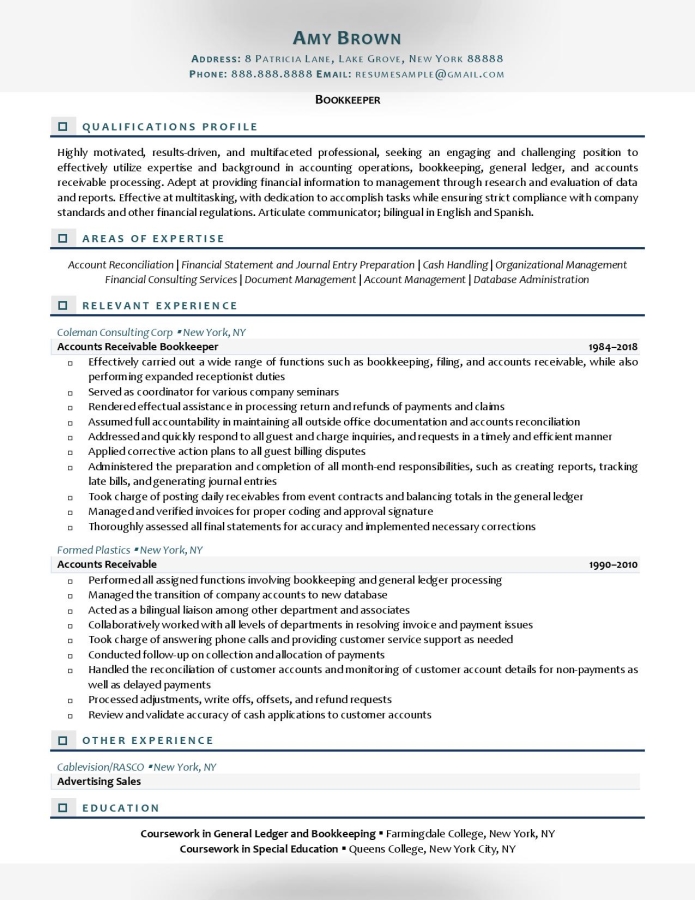

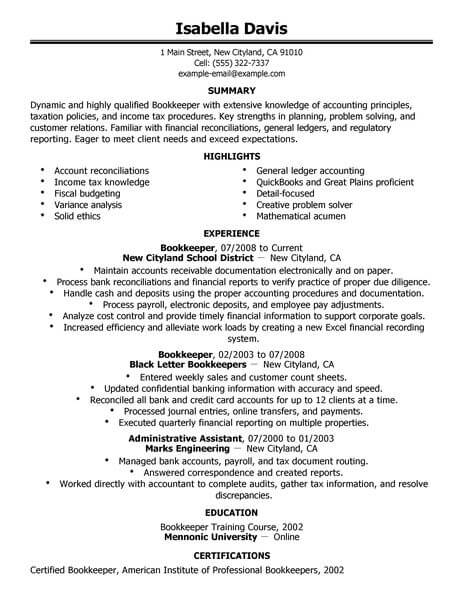

Bookkeeper resumes and cover letters

There are certain skills that many bookkeepers have in order to accomplish their responsibilities. By taking a look through resumes, we were able to narrow down the most common skills for a person in this position. We discovered that a lot of resumes listed analytical skills, math skills and writing skills.

Post this Bookkeeper job ad to 18 free job boards with one submission

Post this bookkeeper job ad to 18+ free job boards with one submission start a free workable trial and post your ad on the most popular job boards today.

What is a Bookkeeper?

Bookkeepers oversee a company’s financial data and compliance by maintaining accurate books on accounts payable and receivable, payroll, and daily financial entries and reconciliations. They perform daily accounting tasks such as monthly financial reporting, general ledger entries, and record payments and adjustments. Additionally, many bookkeepers also assist with basic hr duties like new hire documents, compliance, and temporary disability insurance and workers’ compensation filings, making them an indispensable part of an organization’s fiscal fitness.

Bean counter's bookkeeping explained course hello my name is dave and yes i'm a bean counter. No i didn't say alcoholic, that's a soft drink not a beer in my hand, and this is not a meeting of alcoholics anonymous. For those of you that don't know a bean counter is slang sometimes used to refer to a bookkeeper or accountant.

A bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue sales revenuesales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and "revenue" can be, and often are, used interchangeably, to mean the same thing. Revenue does not necessarily mean cash received. , invoices, and payments. The bookkeeper will record financial data into general ledgers, which are used to produce the balance sheet balance sheetthe balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting. The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. Assets = liabilities + equity and income statement income statementthe income statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. This statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The bookkeeper is generally responsible for overseeing the first six steps of the accounting cycle accounting cyclethe accounting cycle is the holistic process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements, to closing the accounts. The main duty of a bookkeeper is to keep track of the full accounting cycle from start to finish, while the last two are typically taken care of by an accountant. While there is a general overlap between the two professions, there are a few distinctions that are later discussed in this article.

Today's career as a professional bookkeeper offers you the benefits of security, prestige, advancement and a good, steady income. Few jobs can give you the opportunity to work in so many different kinds of businesses and industries. Consider all the interesting and exciting places you can work: the entertainment, fashion and advertising industries or for lawyers, doctors, business executives or politicians. Work in the travel and hospitality industry. Work for businesses and corporations of all kinds: stockbrokers, banks, retail stores, airlines, list goes on and on! no other single career offers so many choices. No matter where you live or choose to go, there are always plenty of opportunities for professional bookkeepers.

The accounting / bookkeeper is responsible for maintaining the financial records of a company by accurately recording the day to day financial transactions. They will perform a range of general clerical, accounting and bookkeeping support functions within a business. Must be knowledgeable of accounting software such as quickbooks. Must be able to post invoices, cash receipts, supplier invoices and related financial transactions as well as reconcile accounts to ensure their accuracy.

Requirements and responsibilities bookkeeper maintains and records a complete and systematic set of business transactions. Balances ledgers, reconciles accounts, and prepares reports to show receipts, expenditures, accounts receivable, and payable. Being a bookkeeper follows bookkeeping procedures established by the organization. May require an associate degree or its equivalent. Additionally, bookkeeper typically reports to a supervisor or a manager. The bookkeeper gains or has attained full proficiency in a specific area of discipline. Works under moderate supervision. To be a bookkeeper typically requires 1-3 years of related experience.

A bookkeeper plays a vital role in a small business by recording and maintaining its financial records. The scope of a bookkeeper's duties depends on the size of a company and its needs. Most bookkeepers work for smaller companies that don't have an accountant on staff. Unlike accountants, bookkeepers don't usually need an accounting or other business degree to gain employment. Not having one limits their ability to advance professionally, howevers. Companies with bookkeepers often use outside cpa firms to prepare year-end tax returns and monitor the overall financial health of the company. Bookkeepers prepare the records that are reviewed and used by the company's accountant.

Difference Between Bookkeeper and Accountant

The key difference between bookkeeper and accountant is that bookkeeper is responsible for performing the bookkeeping activities in the company where financial transactions are recorded in a systematic manner, whereas, accountants are responsible for accounting of the financial transactions that have occurred in the past by the company as well as reporting the financial affairs of the company which shows the clear financial position of company.

The basic differences between nonprofit bookkeeping and accounting are outlined below: nonprofit bookkeepers and accountants are both incredibly important to organizations. They’re both necessary for effective, well-informed financial decision-making. Ready to learn more? let’s dive in.

It can be hard to understand the difference between a bookkeeper and an accountant – especially since many accountants may perform bookkeeping duties as well as accounting duties. A good way to think about the difference between the two is that the bookkeeper keeps financial records about your business activities, while your accountant will analyse these records and give you advice on how to act accordingly.

General Ledger Accounts (GL): How They Are Used in Bookkeeping

A bookkeeper’s duties will always include a fair bit of data entry and receipt wrangling. They’re responsible for recording every financial transaction in your general ledger using double-entry bookkeeping —usually called recording journal entries. That sounds like a mouthful, but often that just looks like inputting all your transactions into accounting software.

Bachelor's degree in accounting, finance, or related field 3-5 years relevant experience working in accounting and bookkeeping thorough knowledge and understanding of gaap strong verbal and written communication skills proficient skills in quickbooks and microsoft excel experience with accounts payable, accounts receivable, payroll, and general ledger high degree of accuracy and attention to detail ready to hire a bookkeeper?.

This group performs some or all of the following duties: keep financial records and establish, maintain and balance various accounts using manual and computerized bookkeeping systems post journal entries and reconcile accounts, prepare trial balance of books, maintain general ledgers and prepare financial statements calculate and prepare cheques for payrolls and for utility, tax and other bills

bookkeeping, accounting, and auditing clerks earned a median annual salary of $38,390 in 2016, according to the u. S. Bureau of labor statistics. On the low end, bookkeeping, accounting, and auditing clerks earned a 25th percentile salary of $30,640, meaning 75 percent earned more than this amount. The 75th percentile salary is $48,440, meaning 25 percent earn more. In 2016, 1,730,500 people were employed in the u. S. As bookkeeping, accounting, and auditing clerks.

Bookkeeping salaries vary by region and industry. The median annual salary for bookkeeping, accounting, and auditing clerks was $28,570 in 2004, according to the bureau of labor statistics.

According to the u. S. Department of labor, bureau of labor statistics, the average yearly salary for accounting, auditing and bookkeeping clerks was $40,240 as of 2018, while the top ten percent earned more than $61,650 that year. The most common employment industries for bookkeeping, accounting and auditing clerks that year were:.

Search

Categories

- Stock Trader

- Criminologist

- Coworker Leaving

- Mortician

- Virologist

- Veterinary Technician

- Title Examiner

- Team Leader

- Technical Recruiter

- Senator

- Scribe

- Perioperative Nurse

- pediatrician

- Modeller

- Military

- Economist

- Coworker

- Captain

- Arborist

- Voter

- 14

- 12

- Worker

- Chemistry

- Actuary

- Actor

- Announcer

- Wellness Nurse

- Judge

- Academic Dean

- Administrator

- Agricultural

- Administrative Assistant

- Agronomist

- Barber

- Analyst

- Pharmacist

- Call Center Support

- Cameraman

- Interventional Radiologist

- Wedding Officiant

- Politics

- Public Health

- Respiratory Therapist

- Singer

- Sniper

- Teacher

- Manatee

- Hacker

- Gambling

- Flight Attendant

- Entertainer

- Employee

- Daily Nutritionist

- Kitchen Manager

- Astronomer

- American Upholsterer

- Activist

- Accountant

- Writer

- Vice President

- Inventor

- Drafter

- Debater

- Carpenter

- Baker

- Attorney

- Astronaut

- Advisor

- Occupational Therapist

- Nutritionist Fact

- Municipal Arborist

- Management

- Mail Carrier

- Livestock Farmer

- Landscape Contractor

- Land Surveyor

- Insurance Investigator

- Insurance Broker

- Inspector

- Hunter

- Historian

- Hiker

- Hairstylist Black

- Hairstylist

- Gunsmith

- Gun Shooter

- Grant Writer

- Government Auditor

- Gold Panning

- Gardener

- Forensic

- Fisherman

- Fireman

- Firefighter

- Esthetician

- Entrepreneur

- Engineer

- EMT

- Electrician

- Driller

- Doctor

- Diver

- Dispatcher

- Dishwasher

- Director

- Dietitian

- Detective

- Dancer

- Creative Writing

- Counselor

- Cloud Architect

- Climber

- Chef

- Chairman

- Cardiac Sonographer

- Boss

- Bookkeeper

- Bee Keeper

- Bartender

- Auctioneer

- Architect

- Appraiser

- Watchmaker

- Wanker

- Typist

- Trooper

- Train Controller

- Tool and Die Maker

- Therapist

- Technician

- Surgeon

- Supervisor

- Stripper

- Soldier

- Sociologist

- Social Worker

- Sheriff

- Sexy Pick Up Lines

- Self Reminder

- Secretary

- Scientist

- Scheduler

- Sailor

- Roofer

- Marshal

- Manager

- Librarian

- Lawyer

- Landscaper

- Investigator

- Retirement

- Registered Nurse

- Recruiter

- Records Clerk

- Realtor

- Rancher

- Quilter

- Psychology

- Psychologist

- Principal

- Priest

- Postmaster

- Office Assistant

- Nutritionist

- Nurse

- Network Administrator

- Mechanic

- Mayor

- Podiatrist

- Plumber

- Planner

- Pipe Fitter

- Pilot

- Photographer

- Phlebotomy Technician

- Painter

- Nurse Practitioner

- Identifier

- Lacemaker

- HRD

- Hatter

- Host

- Herdsman

- Bouldering

- Assassin

- Bomberman

- Army

- Attendant

- Blogger

- Clergyman

- Cashier

- Botanist

- Bodyguard

- Aquascaping

- Assistant

- Electorate

- Physician

- Arbitrator

- Administrative