Certified public accountants (CPAs)

by Caroline

Posted on 23-12-2020 08:41 PM

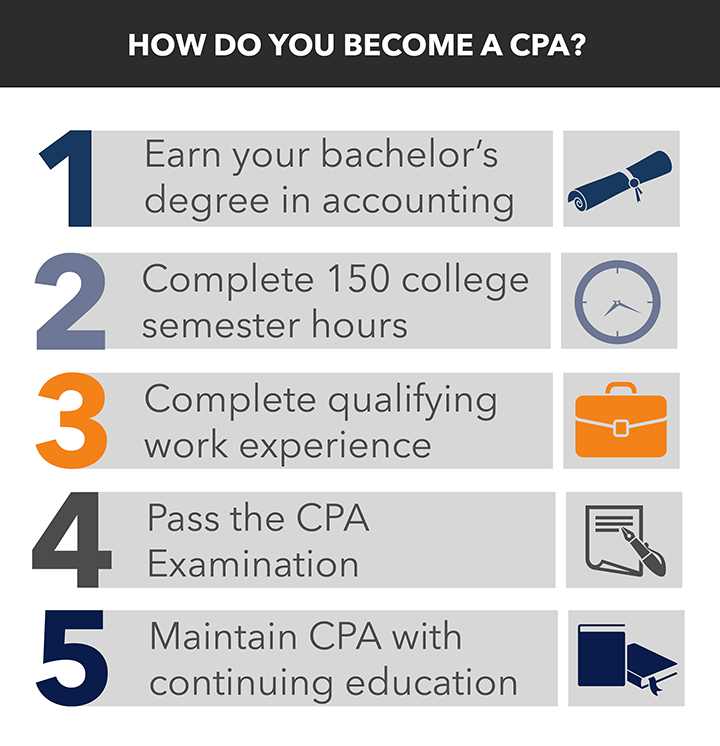

In addition to these requirements, a prospective cpa must receive a passing score on the uniform certified public accountant gag gift funny accountant coffee mugs accountant christmas gifts examination (cpa exam).

The best way to promote an accounting business is by establishing relationships with local business owners and professionals. Attend networking events and conferences. Join the national association of tax professionals (natp) and/or the american institute of certified public accountants (aicpa) so you can learn as much as possible about the industry and stay up to date on trends. Advertise throughout the community with flyers, brochures, press releases, ads on radio stations, commercials on local tv, regional magazine ads, town newspaper ads, etc. Make sure your website looks professional and has an intuitive user experience design. All website content should be optimized for search engines (seo), so locals find your accounting service when conducting online searches for accountants within the community.

Work experience can help you advance in the field of accounting, and some states require it to take the certified public accountant (cpa) exam. By taking an entry-level accounting position, or possibly an internship, aspiring accountants have an opportunity to observe the duties and responsibilities they'll perform on a daily basis.

Accounting assistants often receive more complex tasks and greater responsibilities the longer they work in their positions, especially if they have only a high school diploma. After several years of working with a single company, accounting assistants often transition to junior accountant roles. This transition may require more formal education. Accounting assistants who have a bachelor's degree in accounting or a related field may advance to a role as a staff accountant, an auditor, or an accounting manager. After obtaining cpa certification , accounting assistants may also work as certified public accountants (cpas).

Most graduates of accounting programs earn the certified public accountant (cpa) designation. This is a must for any accountant filing a report with the securities and exchange commission, but many accountants find the designation enhances their job prospects and helps them gain clients. Although a master's degree is not required to become a cpa, almost all states require cpas to have a minimum of 150 semester hours of college -- about 30 hours more than the typical bachelor's degree.

Dona dezube, monster finance careers expert hoping to become the chief financial officer (cfo) someday? you'll need more than your cpa credential and experience as a controller. Consider these dos and don'ts as you work your way up the accounting career ladder. Five for the to-do list do develop strong relationship skills: "cfos must have a good working relationship with the chief executive officer, their direct reports and others within their organization," says john morrow, vice president of the american institute of certified public accountants. A good cfo has a finger on the pulse of the business and industry. "external relationships are important, too, with bankers, capital markets, peers in other companies and professional associations," he adds.

Skills Required for an Accountant Career

Are you thinking of becoming an accountant or already started your career and planning the next step? learn how to become an accountant, what skills you need to succeed, how to advance your career and get promoted, and what levels of pay to expect at each step on your career path. Explore new accountant mugs accountant tax mugs funny accountant mugs job openings and options for career transitions into related roles.

When you train to do a specific job it can often mean that you are then limited to a narrow career path within a relevant industry where those skills are applicable, however, being a qualified accountant allows you to work in almost any industry. If you would like to work in a sector or.

Accounting courses are an excellent way to diversify education and experience while gaining professional skills for a career, whether you are already an accountant needing to brush-up on your skills, or interested in a career change. There are accounting courses located in several countries and each is specific to a certain sector. Requirements for courses vary, but generally, prospective students need previous education and/or experience.

If you know or have ever been told that you are good with numbers, the question, “how do you become an accountant?†may have crossed your mind. This type of work is a great fit for people who have good critical thinking skills and are able to analyze data. The work of an accountant is not just about poring over figures, though; a person who chooses this type of career also needs to be able to clearly explain the results of his or her analysis to managers, co-workers and clients, which means that communication skills must be top notch.

What kind of skills should you include on your resume? avoid hobbies and interests — instead, focus on your hard and soft skills and achievements: include key accounting skills on your resume to show the hiring manager you have what it takes to succeed as an accountant. The basic accounting skills required for an accountant include more technical skills than many other professions. For instance, your math abilities should be at a high level since errors can end up costing a company or firm a lot of money.

Accountants and auditors work with financial documents and efficiently and accurately organize large data sets; therefore, they must have a familiarity with a range of financial management and budgeting software, as well as generally accepted accounting principles (gaap) and accounting processes. Important technical skills for those pursuing a career in accounting include:6,7,8.

CMA Accounting: What Is It and How Do You Become One?

Accounting managers are highly educated.

While specific requirements will vary depending on the organization, you will need a bachelor’s degree in accounting, finance or business, and, in some cases, a master’s degree. Employers will also ask for at least five years of experience, and many require finance and accounting certifications , such as the cpa, certified management accountant (cma) or chartered global management accountant (cgma).

While specific requirements will vary depending on the organization, you will need a bachelor’s degree in accounting, finance or business, and, in some cases, a master’s degree. Employers will also ask for at least five years of experience, and many require finance and accounting certifications , such as the cpa, certified management accountant (cma) or chartered global management accountant (cgma).

Chicago, il, january 21, 2020 /24-7pressrelease/ -- new accountant magazine , a trusted professional journal for college accounting students since 1985, published its latest issue, available in both print and digital editions. The featured cover story, " beyond the numbers: accounting skills for the future " by christian cuzick , cma, vice president of finance, johnson & johnson vision , chair, ima® ( institute of management accountants ), you will learn how technology has transformed accounting and finance work; and the opportunities it has provided for three young professionals currently working in these "new" areas, and who are moving beyond the numbers.

Step 1: Meet Accounting Degree Requirements

Most states are moving toward a 150-hour master’s degree in accounting requirement to become a cpa. Each state lists the number of accounting courses you must take and the types of courses. Your college advisor can help you plan your course of study to meet the credit hours and other requirements. In lieu of an accounting degree, you may be able to earn a bachelor’s degree in another field of business, then take more accounting courses to earn a master’s degree.

Apparently, the first step to become a cpa is to get into a good school and earn a degree in accounting. Having a degree is the most basic qualification towards getting certified. Then, candidates must pass other sets of rigorous requirements. Here are some practical tips and motivation boosters to help you get those letters beside your name.

What You Need to Know About Becoming an Accounting Major

Abstract the major purpose of the study was to determine the record-keeping, inventory control and price determination skills needs of small business operators in anambra state. Three research questions and two null hypotheses were used to attain this purpose. A descriptive survey research design was adopted in the study which involved 280 registered small business operators in the state. Due to the manageable size of the population, all the 280 registered small business operators were surveyed. Therefore there was no sampling. Data were collected with the help of three research assistants using structured cost accounting skills needs (casns) questionnaire with 43-item statements. The questionnaire was divided into four sections (a - d). Section a was used to obtain the personal data of the respondents. Sections b, c and d carried a bipolar scale of perceived importance and expressed possession to obtain the respondents’ ratings of the skills (record-keeping, inventory control and price determination skills). The instrument was validated by three experts. Cronbach alpha reliability technique was used to determine the internal consistency of the instrument. Reliability coefficient of 0. 78, 0. 83 and 0. 75 were obtained for record-keeping, inventory control and price determination skills respectively. Data from 269 copies returned were used for data analysis. Analysis was done using mean and correlated t-test at 0. 05 level of significance to answer the research questions while analysis of variance was used to test the two null hypotheses. The study found that record-keeping, inventory control and price determination skills were perceived to be very important by the operators, but the levels of possession were still below expectation. Based on these findings, the study recommended that a training programme be mounted for small business operators in the state on record-keeping and inventory control skills needed for business operation.

Investopedia spoke with richard a. Melancon, a cpa and university of new orleans mba ’82 who helps “small and mid-sized companies to grow and establish themselves in the market; helped start-ups with business plans , loan applications and venture capital funding “about an average day on the job. Melancon’s firm, which has operated out of metairie, louisiana since 1989, offers “business training, consulting services, computer security assessments,†as well as “ tax planning , financial planning and income-tax preparation. †melancon says one of the major perks of his job is that despite the long tax season hours, accounting allows for “greater freedom the rest of the year. â€.

A major branch of accounting is financial accounting: the collection, recording and analysis of financial information in order to periodically summarize this information in financial reports and statements, in accordance with legal, professional and capital market requirements, to external users (usually decision-makers such as investors, government agencies and suppliers).

Accounting and finance sector has been going through some major changes lately. If you want to be successful in recruiting accounting and finance professionals, you have to stay up to date on accounting and finance employment trends and challenges. Here are the 3 key challenges in accounting and finance recruiting:.

The majority of international accounting positions require candidates to have at least five years of related work experience, though some require as little as two years. Very few of these positions are entry level, though it is not impossible to find them, particularly if you graduated from a top-level college or university. Keep in mind that some employers will be looking for applicants who specialize in one or more areas of accounting. If there is at least one aspect of this field that you could claim expert-level experience in, or call it a specialty, you may have an advantage over your competitors.

For some years there has been much debate between various stakeholders about the need for accounting graduates to develop a broader set of skills to be able to pursue a career in the accounting profession. This study uses mixed methods to examine perceptions and expectations of two major stakeholders: students and employers. Findings indicate that students are becoming aware of employers’ expectations in terms of communication, analytical, professional and teamwork skills. Although employers are still expecting a good understanding of basic accounting skills and strong analytical skills, they are also requiring ‘business awareness’ and knowledge in terms of the ‘real world’. Both students and employers report that many of the ‘essential’ nonâ€technical and professional skills and attributes are not being developed sufficiently in university accounting programmes.

Just as you began to get a handle on robotic process automation , along came ai― with blockchain technology hot on its heels. And while it’s tempting to ignore both and hope they go away, they’re not going to, and could impact you far sooner than you may think. In an accounting today article , gary bolinger, president and ceo of the indiana cpa society, predicts that tech will outpace our growth expectations in 2018. He says that this includes ai and blockchain, which will “be a major factor for firms and companies of all sizes much sooner than most professionals expect. â€.

What Is an Accounting Major?

New york ( mainstreet ) — while the majority of small business owners claim they are confident about managing their finances, only 45% can define basic accounting principles. A survey conducted by staples, the office supplier, revealed that 94% of small business owners said they can manage their finances, yet less than half can define the basic accounting principles such as "accounts receivable" and "accounts payable. ".

Advertisements a relative of mine is in his 2nd year of college and has decided on an accounting major. She said that the first two accounting classes were the hardest and the professor made a point to tell the class that a good percent of the class would bomb out because they just could not handle it. The professor said, "some of you will be bored, some of you don't have the intellectual skills to handle the complexity of the subject and some of you will admit to yourself that the study of accounting is just too complex. ".

There is a crisis in the management accounting profession, and it’s one that threatens to have a major impact on the world’s economy. Around the globe, there is a talent gap in the finance function that prevents businesses from achieving optimal performance. While companies are seeing many accounting applicants with basic skills—entry-level tax and audit work, for example—there is a dearth in the proficiencies needed to lead teams and drive business forward. This lack of highly-skilled labor is making it nearly impossible to adequately fill key accounting positions inside organizations, hampering performance, growth and economic expansion.

FNU’s Accounting Degree Program

Coursera is another online training provider that currently offers more than 250 accounting courses, including introductions to financial accounting, business and financial fundamentals, and finance for non-finance professionals. You can even earn a master of science in accounting if that's your goal. Coursera courses are available at the certificate, specialization or degree level. Certificate courses typically take about four weeks to complete and cost less than $100, with a certificate issued upon completion. Specialization courses take four to six months to complete and range in price from $39 to $79 per month. Coursera's degree programs take one to three years to complete and cost up to $25,000.

Accredited accounting schools best accounting bachelor programs 2018 best accounting master’s programs 2018 best 100% online accounting master’s programs 2018 most affordable bachelor degree programs in accounting most affordable master’s degree programs in accounting.

Most professional accounting jobs require a bachelor's degree. If you've completed an associate degree, you may want to consider enrolling in a bachelor's in accounting program to obtain the additional credential, which can make a big difference when being considered for a new role. While most accounting jobs do not necessarily require a master's degree, if you are planning on sitting for the cpa, you will need 150 college credit hours in order to take the exam (most bachelor's programs are 120 credits, meaning you will need to complete an additional 30). These credits do not have to all be in the accounting field, and can be at either the graduate or undergraduate level. Some people choose to fulfill this requirement by completing an accounting certificate or a master's degree in accounting (depending on the number of credits they have to finish in order to reach the 150 hour minimum). Some people also take this opportunity to explore a new subject area and will pursue an mba or a certificate in a related field.

Accounting and programming skills are rare skill sets that can easily make you a king amongst kings in the accounting and finance realm. There are things that excel sheets alone cannot help with. You have to learn to write computer programs that can do things faster and with high degree of accuracy.

1. Accountants Have a Better Understanding of Finances

9:55Â am est, wednesday, november 6, 2013 while most of us think about accountants as people who spend their days working on complex spreadsheets calculating the finances of a company there is far more to those who practice this profession. In fact, there are many characteristics of an accountant that make them unique in our circle of friends. The mindset of most people who are uniquely qualified to pursue a career in accounting can be defined by understanding some specific qualities including:.

Career Paths and Jobs in Accounting

When you are done with your education, you can start applying for jobs. You can even apply for jobs while pursuing a higher certification. Typically, companies hire fresh graduates and train them as per their needs and requirements. There are several career options in accounting to choose from allowing you to work in many types of industries. Always keep in mind that employers are always looking for individuals that possess training and experience, as well as other important intangible skills.

If you’re like most graduates, you already have experience with the public from working a part-time job. Whether you’ve worked in food service, retail, or hospitality, part-time jobs are invaluable experiences that help you develop those important customer service skills early. When you work for an accounting firm or business client, you’re expected to maintain a good relationship, retain existing customers, and bring in new clients. Customer service skills are just as crucial to the success of your career as your accounting knowledge itself.

There are many distinct accounting certifications that accountants can earn in order to improve their careers, attain promotions, and acquire raises in their pay. The certifications are somewhat different from each other and focused toward different career paths. Many accountants have more than one of these credentials to diversify their paths.

Learning About the Various Career Fields in Accounting

Accounting makes the top ten of the highest paid career fields. If you choose this career field, not only will you be setting yourself up for the amazing earning potential, you will be securing your future to live comfortably. The best part? your salary can only go up as you advance from one field to the next.

As you work to grow your career, consider earning in-demand accounting certifications. And always look for opportunities to get training that will make you more marketable as a job candidate, and more valuable as a team member. That said, for many of the above skills, on-the-job experience is the best method for learning. One way to gain that experience is by working in temporary accounting and finance positions while you build up your resume and search for a full-time role.

Accounting Career Path Planning

Accounting-entries-for-sale-of-fixed assets accounting-entries-for-sales-return-and-purchase-return what-is-adjusting-entries? types-of-adjusting-entries. What-is-sales-day-book-and-purchase-day-book? what-is-depreciation? what-are-the-methods-of-depreciation? accounting entries for provident fund what-is-nominal-account-and- real -account? what-is-sunk-cost? what-is-closing-stock? what-are-the-accounting-treatment-of-closing-stock?why-closing-stock-not-shown-in-the-trial-balance? accounting entries-of loan-taken-and-loan-repayment determination profit-margin difference-between-profit-margin-and-operating-profit-margin debit-voucher, credit-voucher-and-transfer-voucher what is forensic-accounting? who could be a forensic accountant? what window dressing of financial statement? accounting-treatment-of-revaluation-of-fixed-assets what-is-deferred-tax? what is temporary-difference-and-permanent-difference? what is accounting cycle? the-steps of accounting cycle. What-is-fixed-assets-register? what-is-fictitious-assets? examples-of-fictitious-assets. Wwhat-is-statement-of-changes-in-equity? what-is-invoice?-describe about sales-invoice-purchase-invoice. What is journal-proper? how journal proper is recorded? trading account : definition, items of trading a/c etc. Accounting-treatment of bad-debts-provision-for-bad-debts.

Search

Categories

- Stock Trader

- Criminologist

- Coworker Leaving

- Mortician

- Virologist

- Veterinary Technician

- Title Examiner

- Team Leader

- Technical Recruiter

- Senator

- Scribe

- Perioperative Nurse

- pediatrician

- Modeller

- Military

- Economist

- Coworker

- Captain

- Arborist

- Voter

- 14

- 12

- Worker

- Chemistry

- Actuary

- Actor

- Announcer

- Wellness Nurse

- Judge

- Academic Dean

- Administrator

- Agricultural

- Administrative Assistant

- Agronomist

- Barber

- Analyst

- Pharmacist

- Call Center Support

- Cameraman

- Interventional Radiologist

- Wedding Officiant

- Politics

- Public Health

- Respiratory Therapist

- Singer

- Sniper

- Teacher

- Manatee

- Hacker

- Gambling

- Flight Attendant

- Entertainer

- Employee

- Daily Nutritionist

- Kitchen Manager

- Astronomer

- American Upholsterer

- Activist

- Accountant

- Writer

- Vice President

- Inventor

- Drafter

- Debater

- Carpenter

- Baker

- Attorney

- Astronaut

- Advisor

- Occupational Therapist

- Nutritionist Fact

- Municipal Arborist

- Management

- Mail Carrier

- Livestock Farmer

- Landscape Contractor

- Land Surveyor

- Insurance Investigator

- Insurance Broker

- Inspector

- Hunter

- Historian

- Hiker

- Hairstylist Black

- Hairstylist

- Gunsmith

- Gun Shooter

- Grant Writer

- Government Auditor

- Gold Panning

- Gardener

- Forensic

- Fisherman

- Fireman

- Firefighter

- Esthetician

- Entrepreneur

- Engineer

- EMT

- Electrician

- Driller

- Doctor

- Diver

- Dispatcher

- Dishwasher

- Director

- Dietitian

- Detective

- Dancer

- Creative Writing

- Counselor

- Cloud Architect

- Climber

- Chef

- Chairman

- Cardiac Sonographer

- Boss

- Bookkeeper

- Bee Keeper

- Bartender

- Auctioneer

- Architect

- Appraiser

- Watchmaker

- Wanker

- Typist

- Trooper

- Train Controller

- Tool and Die Maker

- Therapist

- Technician

- Surgeon

- Supervisor

- Stripper

- Soldier

- Sociologist

- Social Worker

- Sheriff

- Sexy Pick Up Lines

- Self Reminder

- Secretary

- Scientist

- Scheduler

- Sailor

- Roofer

- Marshal

- Manager

- Librarian

- Lawyer

- Landscaper

- Investigator

- Retirement

- Registered Nurse

- Recruiter

- Records Clerk

- Realtor

- Rancher

- Quilter

- Psychology

- Psychologist

- Principal

- Priest

- Postmaster

- Office Assistant

- Nutritionist

- Nurse

- Network Administrator

- Mechanic

- Mayor

- Podiatrist

- Plumber

- Planner

- Pipe Fitter

- Pilot

- Photographer

- Phlebotomy Technician

- Painter

- Nurse Practitioner

- Identifier

- Lacemaker

- HRD

- Hatter

- Host

- Herdsman

- Bouldering

- Assassin

- Bomberman

- Army

- Attendant

- Blogger

- Clergyman

- Cashier

- Botanist

- Bodyguard

- Aquascaping

- Assistant

- Electorate

- Physician

- Arbitrator

- Administrative