Accountancy Forum

by Sandra

Posted on 19-11-2020 04:29 PM

Hi and welcome to my blog! i am md.

Alamgir, a part qualified chartered accountant of icab, the learning partner of icaew. I am masters in accounting. I have 10 years job experience in finance and accounts. My educational back ground and job experience give me the opportunity to make this blog where i tried to explain several issues that an accountant is doing in his job field.

Alamgir, a part qualified chartered accountant of icab, the learning partner of icaew. I am masters in accounting. I have 10 years job experience in finance and accounts. My educational back ground and job experience give me the opportunity to make this blog where i tried to explain several issues that an accountant is doing in his job field.

6. Proficiency in preparing financial statements

There is a difference between being an accountant and a certified public gifts for an gifts for an accountant gift for an accountant funny accounting gifts gift for an accountant funny accounting gifts . Though both require a bachelor’s degree in accountancy, an accountant has not yet taken the state licensure or certification for accountants but may still perform accounting tasks such as preparing financial statements and tax returns. On the other hand, the certified public accounting for gifts accounting gag gifts accountant gifts ideas has been licensed by the state, passed the cpa examination, and completed a required number of hours of apprenticeship under a cpa.

Maintained general ledgers, managed cash flow, prepared financial statements and bank reconciliations for multiple development and construction projects. Prepared month end financial statements to analyze and summarize current and projected company financial position with a comparative narration. Assisted auditors by collecting and providing schedules and data, preparing and verifying financial statements and other miscellaneous information.

The first step in preparing an income statement is to choose the reporting period your report will cover. Businesses typically choose to report their income statement on an annual, quarterly or monthly basis. Publicly traded companies are required to prepare financial statements on a quarterly and annual basis, but small businesses aren’t as heavily regulated in their reporting. Creating monthly income statements can help you identify trends in your profits and expenditures over time. That information can help you make business decisions to make your company more efficient and profitable.

An accountant is a professional who engages in accounting, by preparing and auditing financial statements, bookkeeping, and financial analysis. An accountant may also qualify to give tax advice and prepare tax returns.  accountants don't have to take a licensing exam and they are not licensed in a state. They don't have continuing education requirements.

What Does an Accountant Do? Role, Responsibilities, and Trends

Accountant job description.

A bookkeeper handles the day-to-day task of recording financial transactions, including purchases, receipts, sales and payments. Many small businesses use software such as quickbooks or xero to keep track of their entries, debits and credits. [looking for accounting software? check out our best picks. ]the experts from accounting coach assert that a bookkeeper's role can vary depending on the size of the business and its unique needs. For instance, at a very small company that does not have an accountant gifts funny tax accountant coffee mugs mugs for accountant , a bookkeeper will have more extensive responsibilities. They will be responsible for processing payables, receivables, payroll, and related tasks that are more widely distributed in larger companies. At larger companies, according to xero , bookkeepers are often expected to do data entry, bank reconciliation and monthly reports.

The book “accountants’ roles and responsibilities in estates and trusts†notes that, in most circumstances, the law considers the relationship between an accountant and client to be a confidential one. Confidential information is privileged information that generally is not known that a client shares with an accountant for a specific purpose. The accountant is obligated to protect this information from unauthorized disclosure or public release. Because accountants comply with the confidentiality principle, clients feel free to speak frankly and reveal relevant facts regarding accounting issues, enabling the accountant to act in the client's best interest.

What is an Accountant?

We are talking about how an accountant can help you. Do you like saving money? do you have a side hustle in addition to a “regular jobâ€, or are you skipping the regular job altogether and having one or more side hustles, or are you house hacking, or do you have a home based business? if any of these apply to you, or if you are thinking about exploring these opportunities then you will want to watch this show! an accountant is more than someone who can do your taxes for you, they can save you lots of money. Even if the situations i mentioned about don’t apply to you, we have some stories about how using an accountant can save you money on this episode of pm update.

Accounting-entries-for-sale-of-fixed assets accounting-entries-for-sales-return-and-purchase-return what-is-adjusting-entries? types-of-adjusting-entries. What-is-sales-day-book-and-purchase-day-book? what-is-depreciation? what-are-the-methods-of-depreciation? accounting entries for provident fund what-is-nominal-account-and- real -account? what-is-sunk-cost? what-is-closing-stock? what-are-the-accounting-treatment-of-closing-stock?why-closing-stock-not-shown-in-the-trial-balance? accounting entries-of loan-taken-and-loan-repayment determination profit-margin difference-between-profit-margin-and-operating-profit-margin debit-voucher, credit-voucher-and-transfer-voucher what is forensic-accounting? who could be a forensic accountant? what window dressing of financial statement? accounting-treatment-of-revaluation-of-fixed-assets what-is-deferred-tax? what is temporary-difference-and-permanent-difference? what is accounting cycle? the-steps of accounting cycle. What-is-fixed-assets-register? what-is-fictitious-assets? examples-of-fictitious-assets. Wwhat-is-statement-of-changes-in-equity? what-is-invoice?-describe about sales-invoice-purchase-invoice. What is journal-proper? how journal proper is recorded? trading account : definition, items of trading a/c etc. Accounting-treatment of bad-debts-provision-for-bad-debts.

Accountants manage a lot of responsibility in an organisation, so it’s safe to say they are important people. An honest mistake made by an accountant such as adding or omitting a single digit to a set of numbers can have a huge impact on how accounting books will look like and on the decision making process.

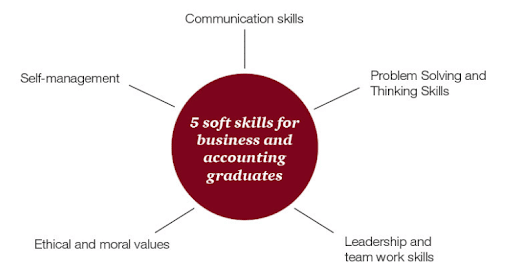

The benefits of developing your soft skills fit into two basic categories – benfits for your organisation and benefits for you. Organisations invest a lot in their accountants. However they want the benefit of that great thinking, analysis and insight. They want you to share it with the wider organisation. Soft skills enable that to happen. They have the potential to create an enormous return on investment for organisations investing in their accountant’s soft skills.

Looking for an online accounting degree? search over 17,000 online programs: what kind of training is required to become an accountant? most accounting jobs require at least a bachelor’s degree, but with an associate degree in accounting, you may be able to perform some accounting tasks, like payroll, for an employer. Many colleges and universities offer accounting programs at the bachelor’s degree level. These programs include coursework in accounting principles, finance, management, economics, statistics, and ethics. Learning to work with accounting systems and tools like spreadsheets and databases is also important. Many accounting degree programs require students to take on internships to gain practical experience.

Acca has developed 12 ‘behaviours’ (see right) in its competency framework that it believes are the most important to acquire and nurture. They include everything from having a healthy sense of scepticism through to being a good problem solver. By way of example, gareth owen, qualifications development manager at acca, explains ‘scepticism’: a requirement that has come about from the scandals and perceived shortcomings of accountants and auditors during the recent financial crisis.

Just up the ladder from bookkeeping is accounting. An accountant typically holds a bachelor’s or a master’s degree. While not recognized as certified by the irs, accountants can generate financial statements, prepare tax documents, and conduct audits of a company’s ledgers.

What Does a Tax Accountant Do?

We've already covered that accountants aren't mathematicians. So what do they do for their clients? consultancy and advice forms the bulk of what accountants provide today - using their expert knowledge to help their customers select the right business structure, minimise unnecessary tax expenditure, and forecast their cash flow for the coming year.

Financial transactions need to be logged correctly, and the financial performance of businesses need to be reported on at regular intervals. These are the classic duties of an accountant, ensuring that businesses keep accurate records, taxes are paid, and the financial statements are reviewed and interpreted. Accountants also provide similar services to individuals who are wealthy or have more complex financial affairs.

The only serious accountant around here. Things have been looking up at the wealthy accountant. Traffic is increasing and the audience is expanding. Even better, the original demographic attracted to the site has expanded, bringing in more people to benefit from the information provided. The newfound success also causes problems. People unfamiliar with the fi (financial independence) community are frequently shocked at the way i present information. It’s an easy thing to do. Right up there in the title is the word accountant. The blog ought to be about taxes and similar stuff found in a cpas office. Then you open the cover and find me standing there. Don’t worry! it would scare me too.

1 cpe credit of computer software & applications for all cpas 1 cpd credit (verifiable) for canadian cpas 1 ce credit of computer technology for maryland tax preparers 1 general educational credit for tax professionals/bookkeepers/accountants.

If you’re interested in how to become an accountant and want to know what they do, i will explain everything you need to know in this article. Accountants prepare, examine, and audit financial records. They check financial records for accuracy, make sure the correct amount of tax is being paid, and that a business is operating lawfully.

Job duties and tasks for: "accountant" 1) prepare, examine, and analyze accounting records, financial statements, and other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards. 2) compute taxes owed and prepare tax returns, ensuring compliance with payment, reporting and other tax requirements. 3) analyze business operations, trends, costs, revenues, financial commitments, and obligations, to project future revenues and expenses or to provide advice.

As you pursue your education you'll be determining which field you would like to pursue. Which area fits you best? • public accounting is the most diverse field. It includes consultants, tax advisers, bookkeepers, auditors and forensic accountants who analyze criminal activities like fraud. €¢ management accountants are responsible for analyzing financial data and creating.

Useful Skills Needed for a Career in Accounting

If you've strong numeracy skills, an analytical mind and are good at managing money, discover all you need to know about becoming an accountant in the uk accounting is often perceived as an uneventful career by those outside of the industry, but it can actually be one of the most fulfilling - whether you choose to work in the private or public sector.

As an accounting professional, you know that a typical year sees periods of intensive workloads evened out by periods of significant downtime. After particularly busy times of the year, you may be tempted to take your foot off the brake and coast for a bit. While this is completely understandable, this is actually the perfect time to strengthen your accounting skills in order to further your career development!.

Courses to Take in an Accounting Degree Program

A cpa is a certified public accountant. You can become a cpa through a combination of formal education and work experience. A number of online colleges offer accounting degrees with cpa options. Cpa programs are designed to help you prepare for the national uniform cpa examination in your state. The first step to becoming a cpa accountant is to earn a bachelor's degree in business administration with a major in accounting from a regionally accredited college. (note that we said “ regionally accredited college ,†not a nationally accredited college—there is a difference!).

There are four levels of accounting degrees and hundreds of institutions offering the accounting degrees. Each institution has specific admission requirements to enter their program and specific requirements which must be successfully completed to earn an accounting degree from their institution. The admission and graduation requirements vary depending on the level of the accounting degree you are seeking and the institution offering the degrees mission.

Before you set your mind to apply for a master’s degree in accounting, you’ll need to know the basic admission requirements. There are thousands of universities which offer master courses in accountancy and surely all their admission requirements aren’t the same with each other. So, we advise you to always take a look at the admission information at the university you are planning to apply at. The list of documents required varies, however, here are some of the most common documents required at most universities:.

Becoming an icaew chartered accountant has never been more accessible. Options to complete elements of the aca qualification include: icaew apprenticeships, undergraduate degrees, postgraduate qualifications, icaew certificate in finance, accounting and business and joint programmes with other professional bodies.

Non-Accounting Skills Successful Accountants Need to Have

A successful candidate should have experience with accounting and financial software and should stay up to date with current trends. Expert-level knowledge of working with spreadsheets is crucial. Experience with word processing software is essential for generating and writing reports for record-keeping as well as presentations. Other experience requirements that accountants should have include management of company finances and drawing up a budget based on income and expenditure accounts. Experience conducting internal and external auditing is an added advantage. Working experience with general ledger functions is required.

Accountant Job Description Template

If you are an employer seeking qualified job seekers for your fund accountant position, read our sample job description below and revise it to meet your company's specific job duties and requirements. If you are a job seeker looking for a fund accountant position, use our sample job description below to see what job skills and experiences employers are seeking.

Education and Accounting Experience

Education: the senior accountant must have a bachelor’s degree (master’s preferred) in finance or accounting. The equivalent of the same in practical experience is also acceptable. The candidate will also be better suited with cpa certification. Experience: a candidate for this position must also have had at least 5 years of working experience in an accounting position within a fast-paced, fast-evolving, and dynamic environment, preferably working as an accountant. The candidate will preferably have had a mix of experience working in a both public company and private company accounting positions.

Ready to keep exploring a career in accounting? whether you're brand-new to the field or eager to open the doors to new opportunities, a solid education is the place to start. *program outcomes vary according to each institution's specific curriculum and employment opportunities are not guaranteed. The salary information listed is based on a national average, unless noted. Actual salaries may vary greatly based on specialization within the field, location, years of experience and a variety of other factors.

What skills do accountants of the future really need?

Like most business professionals, data analysis skills are in great demand. And these skills – along with the ever-increasing availability of large quantities of data – influence other skills accountants will need to succeed in the future. To elaborate, i view accountants’ role inside of organizations as “information engineers,†and responsible for facilitating business decisions. That means that accountants will help determine the best information for the business problem or opportunity the firm faces.

Institute of management accountants president and ceo jeff thomson told an online meeting wednesday of the accountants club of america about how the profession can appeal more to young people by emphasizing technology know-how in areas like data analytics and data science. “this really is a race for relevance and the future of our profession,†said thomson. “it really is about velocity, the rate of change of technology and our ability to absorb and leverage technology for betterment of our effectiveness and efficiency. â€.

An accountant makes sure a company or organization is efficiently operating by accessing their financial records. Duties include analyzing data, finance reports, budgets, tax returns, and accounting records. They send financial reports to their clients that include current financial status, and future trends. They may also recommend ways for their clients to become more financially stable or advise on ways to take advantage of tax incentives.

The graph shows historical and projected (to 2024) employment levels (thousands) for this occupation. Source: *job outlook government website abs labour force survey, department of jobs and small business trend data to may 2019 and department of jobs and small business projections to 2024. Employment for accountants to 2024Â is expected to grow strongly, showcasing great potential for future growth. Employment in this very large occupation (195,800 in 2019) is expected to rise to a total sector size of 214,800 by 2024. The number of people working as accountants grew moderately in 5 years from 181,400 in 2014 to 195,800 in 2019.

In addition to accruals adding another layer of accounting information to existing information, they change the way accountants do their recording. In fact, accruals help in demystifying accounting ambiguity relating to revenues and liabilities. As a result, businesses can often better anticipate revenues while keeping future liabilities in check. Accruals assist accountants in identifying and monitoring potential cash flow or profitability problems and in determining and delivering an adequate remedy for such problems.

Search

Categories

- Stock Trader

- Criminologist

- Coworker Leaving

- Mortician

- Virologist

- Veterinary Technician

- Title Examiner

- Team Leader

- Technical Recruiter

- Senator

- Scribe

- Perioperative Nurse

- pediatrician

- Modeller

- Military

- Economist

- Coworker

- Captain

- Arborist

- Voter

- 14

- 12

- Worker

- Chemistry

- Actuary

- Actor

- Announcer

- Wellness Nurse

- Judge

- Academic Dean

- Administrator

- Agricultural

- Administrative Assistant

- Agronomist

- Barber

- Analyst

- Pharmacist

- Call Center Support

- Cameraman

- Interventional Radiologist

- Wedding Officiant

- Politics

- Public Health

- Respiratory Therapist

- Singer

- Sniper

- Teacher

- Manatee

- Hacker

- Gambling

- Flight Attendant

- Entertainer

- Employee

- Daily Nutritionist

- Kitchen Manager

- Astronomer

- American Upholsterer

- Activist

- Accountant

- Writer

- Vice President

- Inventor

- Drafter

- Debater

- Carpenter

- Baker

- Attorney

- Astronaut

- Advisor

- Occupational Therapist

- Nutritionist Fact

- Municipal Arborist

- Management

- Mail Carrier

- Livestock Farmer

- Landscape Contractor

- Land Surveyor

- Insurance Investigator

- Insurance Broker

- Inspector

- Hunter

- Historian

- Hiker

- Hairstylist Black

- Hairstylist

- Gunsmith

- Gun Shooter

- Grant Writer

- Government Auditor

- Gold Panning

- Gardener

- Forensic

- Fisherman

- Fireman

- Firefighter

- Esthetician

- Entrepreneur

- Engineer

- EMT

- Electrician

- Driller

- Doctor

- Diver

- Dispatcher

- Dishwasher

- Director

- Dietitian

- Detective

- Dancer

- Creative Writing

- Counselor

- Cloud Architect

- Climber

- Chef

- Chairman

- Cardiac Sonographer

- Boss

- Bookkeeper

- Bee Keeper

- Bartender

- Auctioneer

- Architect

- Appraiser

- Watchmaker

- Wanker

- Typist

- Trooper

- Train Controller

- Tool and Die Maker

- Therapist

- Technician

- Surgeon

- Supervisor

- Stripper

- Soldier

- Sociologist

- Social Worker

- Sheriff

- Sexy Pick Up Lines

- Self Reminder

- Secretary

- Scientist

- Scheduler

- Sailor

- Roofer

- Marshal

- Manager

- Librarian

- Lawyer

- Landscaper

- Investigator

- Retirement

- Registered Nurse

- Recruiter

- Records Clerk

- Realtor

- Rancher

- Quilter

- Psychology

- Psychologist

- Principal

- Priest

- Postmaster

- Office Assistant

- Nutritionist

- Nurse

- Network Administrator

- Mechanic

- Mayor

- Podiatrist

- Plumber

- Planner

- Pipe Fitter

- Pilot

- Photographer

- Phlebotomy Technician

- Painter

- Nurse Practitioner

- Identifier

- Lacemaker

- HRD

- Hatter

- Host

- Herdsman

- Bouldering

- Assassin

- Bomberman

- Army

- Attendant

- Blogger

- Clergyman

- Cashier

- Botanist

- Bodyguard

- Aquascaping

- Assistant

- Electorate

- Physician

- Arbitrator

- Administrative