9 Best Excel Skills for Accountants in 2020

by Sandra

Posted on 19-11-2020 04:29 PM

Are you an accountant or an aspiring accountant? do you work in finance? do you want to ensure you are equipped with the core fundamental excel skills that every accountant or financial professional should have? well if so this course has been designed for you. Excel is the tool of choice for most accountants, and having great excel skills can make a massive difference in your career prospects.

accountant gag gifts accountant gift ideas gift ideas for accounting students gag gifts accountant gift ideas gift ideas for accounting students Skills for 2020

As an funny accounting mugs accounting joke gifts accountant joke gifts , you are required to possess the following skill set in order to be able to provide your company/organization with the help it requires.

An interest in business or finance

mathematical and analytical ability

a thorough and methodological approach to work

good it skills.

An interest in business or finance

mathematical and analytical ability

a thorough and methodological approach to work

good it skills.

So what does that mean for you and your business? how can an accountant’s way with numbers and super-human calculating skills make your life easier? here are just a few examples of how using an accountant can help your business grow: an accounting gift ideas mugs present for accountant coffee mugs for accountant can advise on business structure. Is your small business set up as a sole proprietorship or an llc? what’s the difference and what are the benefits of one over the other ? an accountant can point your ship in the right direction and even handle the paperwork to get you there.

Chartered professional accountants are business leaders, strategic thinkers, trusted advisers and financial experts. In a world of disruptive change, cpas create value for businesses and economies by finding new ways to leverage our expertise and business insight to reveal strategic new paths forward. We keep companies at the forefront of change, using data and analytical skills to make informed, insightful decisions — for the good of both business and society.

What does an accountant do?

Reading

read brief e-mail from co-workers, managers and clients. For example, accountants may read e-mail from co-workers requesting instructions for processing uncommon financial transactions. They may read e-mail from suppliers who confirm delivery dates and ask about payments for invoices. (1)

read letters and e-mail from co-workers, managers, suppliers and officials in government departments. For example, cost accountants read about monthly expenses and explanations of budget variances in e-mail from unit and department managers. Accountants for manufacturing plants read e-mail in which managers and supervisors offer suggestions for draft budgets and provide their opinions about predicted changes in business activities. Self-employed accountants read requests for additional financial details and clarifications of financial reports in letters from clients, officials in government departments and financial auditors.

(2).

(2).

Tweet preparing to take the cpa exam is hard work, but it's only the beginning if you wish to become a successful accountant. After you've completed and passed the exam, obtained your license, and nabbed your first job, you're ready to take on the next step in becoming successful—your first year on the job. In today's blog, we'll take a look at what entry-level accountants can expect in their freshman year.

Verify, allocate, post and reconcile accounts payable and receivable produce error-free accounting reports and present their results analyze financial information and summarize financial status spot errors and suggest ways to improve efficiency and spending provide technical support and advice on management accountant review and recommend modifications to accounting systems and procedures manage accounting assistants and bookkeepers.

Q: what's the definition of an accountant? a: someone who solves a problem you didn't know you had in a way you don't understand. Okay, so maybe that's not entirely fair. But as with most humor there's a grain of truth to the joke. Most small businesses choose an accountant -- either hiring a "numbers person" on staff or hiring accounting services on a contract basis -- when a business' financial challenges have become too great to handle without expert help. Maybe you want to better the financial function of your business. Or perhaps your accounting software isn't providing the type of data you need to grow your business. Having trouble switching from cash to accrual accounting? are your financial statements inaccurate or incomplete? these are all good reasons to look for a certified public accountant (cpa).

Macquarie uni and chartered accountants anz launch australia’s first university course module combining big data and accounting.

Every state has unique requirements for the license, so keep reading to learn how to become a cpa in hawaii. The decision to become an accountant can be an important one. There are many different jobs available for those with an accountancy degree, from auditor to forensics to working with information systems. Everyone needs an accountant, including major corporations, mom-and-pop businesses and even individuals who wish to maintain and grow wealth. For that reason, there is a growing demand for accountants. That demand will increase if you attain your state-sanctioned certified public accountant license, as that designation is one of the most difficult to achieve and highly regarded as well. Every state has unique requirements for the license, so keep reading to learn how to become a cpa in hawaii.

What qualifications are needed to be an accountant? the main job of an accountant is to record, process, analyse, prepare and take ownership of various financial and business-related reports. This differs somewhat from what the general finance manager does in the sense that the focus is more on record-keeping rather than the management of money.

The professional skills you need

If you are striving for a successful career in accountancy, there are a number of key skills which you should look to develop and build upon throughout your career. A combination of accredited qualifications and excellent interpersonal and professional skills will enable you to pursue the successful career you are aiming for.

Osf global services uses eskill assessments to measure the specific technical skills needed for its varied it professional positions. This has allowed them to reduce the costs of the selection process by 64% and the time spent by 68%. Read the case study "our strategic partnership with eskill has most helped us in terms of recruitment for jobs which demand very specific and measurable skills, such as that of an it programmer. The specifically targeted online assessments helped us set up entire teams of professional programmers who have taken our business to the next level and have contributed to establishing long-lasting business relationships with our clients. We found that administering eskill tests offered all the information we needed when hiring, and was a great economic solution. ".

What Data and Analytics Skills Do You Need to Advance Your Accounting or Finance Career?

Predictive model forecasting, advanced revenue analytics, and making the shift from spreadsheets to analytics workflows will put you way ahead of your accounting and finance peers—but in case that’s not enough homework for you, here are a few other skills you might want to look into:

cost optimization

real-time model development

data visualization.

How to Stand Out as an Accountant

Every dollar counts for business owners, so if you don't know where you stand on a monthly basis, you may not be around at the end of the year. And while using do-it-yourself accounting software can help monitor costs, the benefits of hiring good accountants extend far beyond crunching numbers. Potentially, they can be your company's financial partner for life, with intimate knowledge of not only how you're going to finance your next forklift, for instance, but also how you're going to finance your daughter's college education.

In accounting/finance jobs overview of the job : this job is a highly paying new business , booming on the accounting sector for providing accounting and book keeping services to the clients. The staff accountant will coordinate with directors and controllers of the firm in providing outstanding client service. This job well suits for accountants having more than 3 years of experience in maintenance of public accounts.

Every bit of money that comes and goes from a business needs to be tracked and accounted for. By adequately recording this information and then studying it, accountants can determine the longevity of a business, financial forecasts and the overall business performance. Are you paying your clients on time? could you find better deals on some of your products? is there money being wasted on a third party when the tasks could be done in house for cheaper? it’s not enough to just run a business and “hope†that it’s successful. It takes a lot of time and effort understand the basic cash flow and how to improve functionality and efficiency.

You must be an accountant or bookkeeper providing professional accounting or bookkeeping services for multiple fee-paying clients in order to become a sage accountants network member. Valid credit card required. A twelve (12) month minimum commitment is required. To ensure continuous service, your sage accountants network membership is an automatically renewing plan, and, depending on the payment option chosen, subsequent years or months will be automatically billed to the same credit card each year or month on the anniversary date of your purchase at the then-current rate. The credit card provided with this purchase will be used to automatically renew the plan if there is no other credit card number already established as your standard credit card number on file with sage. You may terminate your membership plan with thirty (30) days’ advance notice to sage and receive a pro-rated refund. If you terminate your membership or if your payment is not received you will have read-only access to your program and data and full program functionality will not be restored until you have brought your account current.

What Is Computer Accounting?

Prepared consolidated internal and external financial statements by gathering and analyzing information from the general ledger system at month's end. Assisted with sec related filings and prepared quarterly and annual standalone financial statements for 6 projects companies and consolidated financial statements. Managed bookkeeping, prepared trial balance, entered data into computer-based accounting system, and assisted with financial statements.

The right skills for the job.

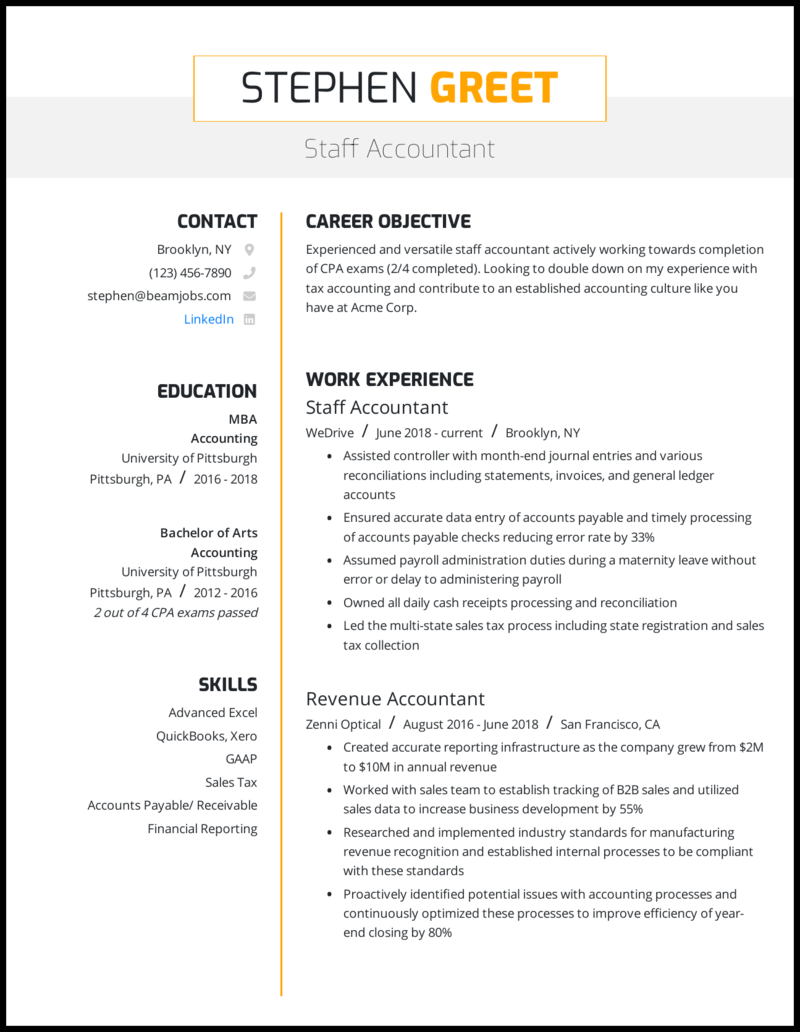

1. How should you format your resume based on your career level? 2. What qualities and traits are employers looking for in this industry, and what should you emphasize? 3. What are the useful skills, certifications, training required for a career in this job category? 1. How should you format your resume based on your career level?.

Is accounting right for you?

What is the type of error? determine the type of error. What do you need to do to fix it? sometimes a simple journal entry is enough. Other times, a direct correction to retained earnings for a prior-period adjustment is on the accounting menu. Do the financial statements have to be restated? restatement means previously issued financial statements are revised, to correct the error. If the error is material or prior-period financial statements are shown with the current year, restatement of the financial statements is a must.

The ability of an individual to keep track of the financial transactions of a business, resulting from its operation over a period of time, is known as his financial accounting skills. This is done by recording, summarizing and presenting all such financial data in the form of financial reports or statements, using standardized guidelines.

Last updated: november 13, 2020 references approved this article was co-authored by darron kendrick, cpa, ma. Darron kendrick is an adjunct professor of accounting and law at the university of north georgia. He received his masters degree in tax law from the thomas jefferson school of law in 2012, and his cpa from the alabama state board of public accountancy in 1984.

2 min read disclosure: our goal is to feature products and services that we think you'll find interesting and useful. If you purchase them, entrepreneur may get a small share of the revenue from the sale from our commerce partners. Finances and accounting don't come easy to everyone. Unfortunately, every entrepreneur needs some financial literacy if you're going to run your ventures responsibly. You need to understand your business's assets and revenues so that you can push the right buttons to help it thrive. You also need to know what you owe in taxes.

We are the american institute of cpas, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

Before starting to prepare an accounting statement it is important to recognize the sum amount of revenue or gross inflow of cash you have in your organization. This revenue may include all the receivables, revenue generated by the assets or sale of goods, etc. The income statement refers to the document prepared to highlight the details of all the incoming and outgoing capital. It needs to be prepared and calculated with all the revenue and expenses details and net profit details. The best way to record the details is to use excel file for the financial analysis.

Topics & objectives introduction to accounting discuss generally accepted accounting principles, the link between accounting and business, and the importance of ethics. Financial statements in accounting identify the balance sheet, income statement and statement of cash flows then learn basic preparation methods for each. Apply fundamental accounting principles. Mechanics of the accounting cycle learn to use the accounting equation, charts of accounts and ledgers. Find out about debits and credits, journal entries and trial balance.

Print this article or save it as a pdf as a company grows, so do its accounting needs. No matter the size of the company there are key points that every accounting department has to hit in order to be successful. A successful accounting department is one that operates as quickly as any other department in the company, but also one that provides decision makers with accurate financial data on their business. More than just record keeping or check writing, a successful accounting department is one that provides the real-time financial information needed to operate in today’s competitive marketplace.

President and owner of accounting advisors, inc. Based in atlanta, georgia founded accounting advisors in 1991 as a consulting services business, but in 2007, he began teaching for continuing education providers as well; his mission since then has been to offer quality training on excel® and additional accounting software via live webcasts, on-demand self-study webcasts, and in-house engagements.

"accountancy" redirects here. For the constituency in hong kong, see accountancy (constituency). For the game, see accounting (video game). Accounting or accountancy is the measurement , processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of users, including investors , creditors , management , and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and " financial reporting " are often used as synonyms.

The lucrative salary is based on demand and makes accounting one of the best business jobs. "few fields are as fertile as the domain of accounting," said robert valli, dean of the liu post college of management in old westbury, n. Y. ,who added that accounting is, in his opinion, recession-proof.

The revenue principle of accounting the revenue recognition principle states that one should only record revenue when it has been earned, not when the related cash is collected. For example, a snow plowing service completes the plowing of a company’s parking lot for its standard fee of $100. It can recognize the revenue immediately upon completion of the plowing, even if it does not expect payment from the customer for several weeks. This concept is incorporated into the accrual basis of accounting.

When it comes to daily accounting business needs, you have a pretty light plate. You have plenty of financial statements to review every week, month, quarter, and so on, but your daily business accounting responsibilities consist of the following:.

Search

Categories

- Stock Trader

- Criminologist

- Coworker Leaving

- Mortician

- Virologist

- Veterinary Technician

- Title Examiner

- Team Leader

- Technical Recruiter

- Senator

- Scribe

- Perioperative Nurse

- pediatrician

- Modeller

- Military

- Economist

- Coworker

- Captain

- Arborist

- Voter

- 14

- 12

- Worker

- Chemistry

- Actuary

- Actor

- Announcer

- Wellness Nurse

- Judge

- Academic Dean

- Administrator

- Agricultural

- Administrative Assistant

- Agronomist

- Barber

- Analyst

- Pharmacist

- Call Center Support

- Cameraman

- Interventional Radiologist

- Wedding Officiant

- Politics

- Public Health

- Respiratory Therapist

- Singer

- Sniper

- Teacher

- Manatee

- Hacker

- Gambling

- Flight Attendant

- Entertainer

- Employee

- Daily Nutritionist

- Kitchen Manager

- Astronomer

- American Upholsterer

- Activist

- Accountant

- Writer

- Vice President

- Inventor

- Drafter

- Debater

- Carpenter

- Baker

- Attorney

- Astronaut

- Advisor

- Occupational Therapist

- Nutritionist Fact

- Municipal Arborist

- Management

- Mail Carrier

- Livestock Farmer

- Landscape Contractor

- Land Surveyor

- Insurance Investigator

- Insurance Broker

- Inspector

- Hunter

- Historian

- Hiker

- Hairstylist Black

- Hairstylist

- Gunsmith

- Gun Shooter

- Grant Writer

- Government Auditor

- Gold Panning

- Gardener

- Forensic

- Fisherman

- Fireman

- Firefighter

- Esthetician

- Entrepreneur

- Engineer

- EMT

- Electrician

- Driller

- Doctor

- Diver

- Dispatcher

- Dishwasher

- Director

- Dietitian

- Detective

- Dancer

- Creative Writing

- Counselor

- Cloud Architect

- Climber

- Chef

- Chairman

- Cardiac Sonographer

- Boss

- Bookkeeper

- Bee Keeper

- Bartender

- Auctioneer

- Architect

- Appraiser

- Watchmaker

- Wanker

- Typist

- Trooper

- Train Controller

- Tool and Die Maker

- Therapist

- Technician

- Surgeon

- Supervisor

- Stripper

- Soldier

- Sociologist

- Social Worker

- Sheriff

- Sexy Pick Up Lines

- Self Reminder

- Secretary

- Scientist

- Scheduler

- Sailor

- Roofer

- Marshal

- Manager

- Librarian

- Lawyer

- Landscaper

- Investigator

- Retirement

- Registered Nurse

- Recruiter

- Records Clerk

- Realtor

- Rancher

- Quilter

- Psychology

- Psychologist

- Principal

- Priest

- Postmaster

- Office Assistant

- Nutritionist

- Nurse

- Network Administrator

- Mechanic

- Mayor

- Podiatrist

- Plumber

- Planner

- Pipe Fitter

- Pilot

- Photographer

- Phlebotomy Technician

- Painter

- Nurse Practitioner

- Identifier

- Lacemaker

- HRD

- Hatter

- Host

- Herdsman

- Bouldering

- Assassin

- Bomberman

- Army

- Attendant

- Blogger

- Clergyman

- Cashier

- Botanist

- Bodyguard

- Aquascaping

- Assistant

- Electorate

- Physician

- Arbitrator

- Administrative